Each year, the National Association of Realtors (NAR) releases its Profile of Home Buyers & Sellers, one of the most reliable snapshots of how Americans are buying and selling homes. This year’s report doesn’t just highlight changing buyer demographics—it paints a clear picture of how the market is shifting as we close out 2025 and look ahead to a new year.

For anyone planning a move in the Omaha metro, these trends matter. Whether you’re preparing to buy your first home or simply watching the market, understanding who’s buying—and why—can help you make smarter decisions.

The First-Time Buyer Landscape Has Shifted

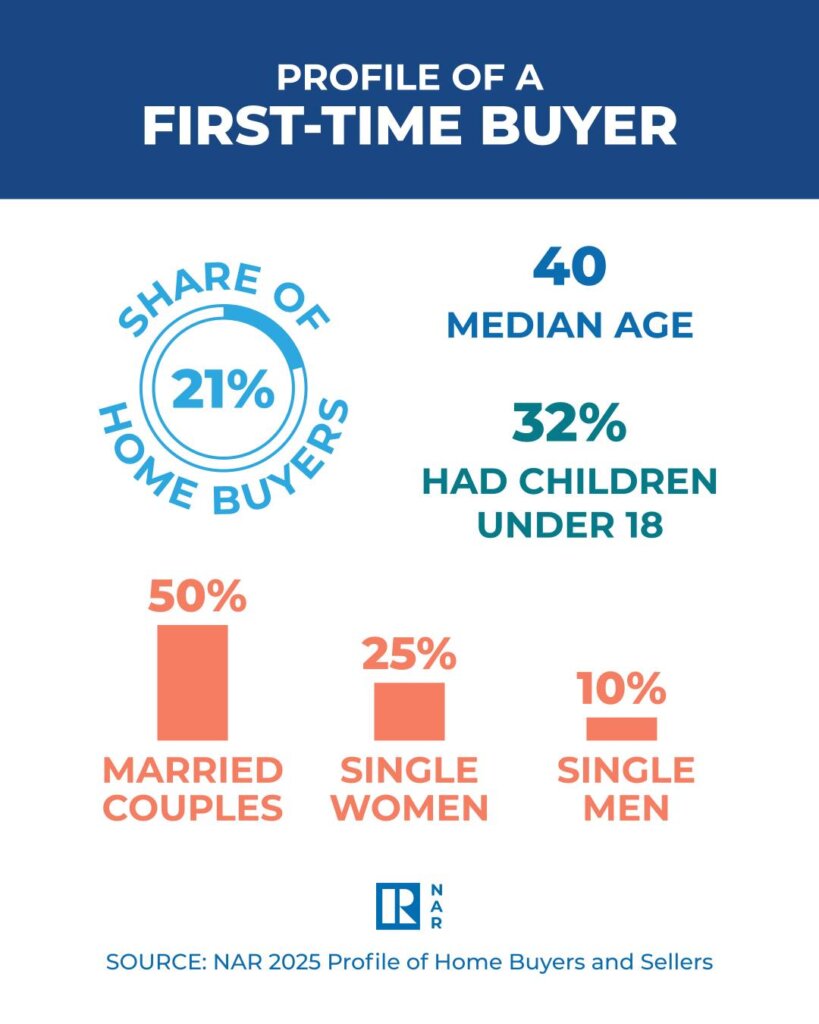

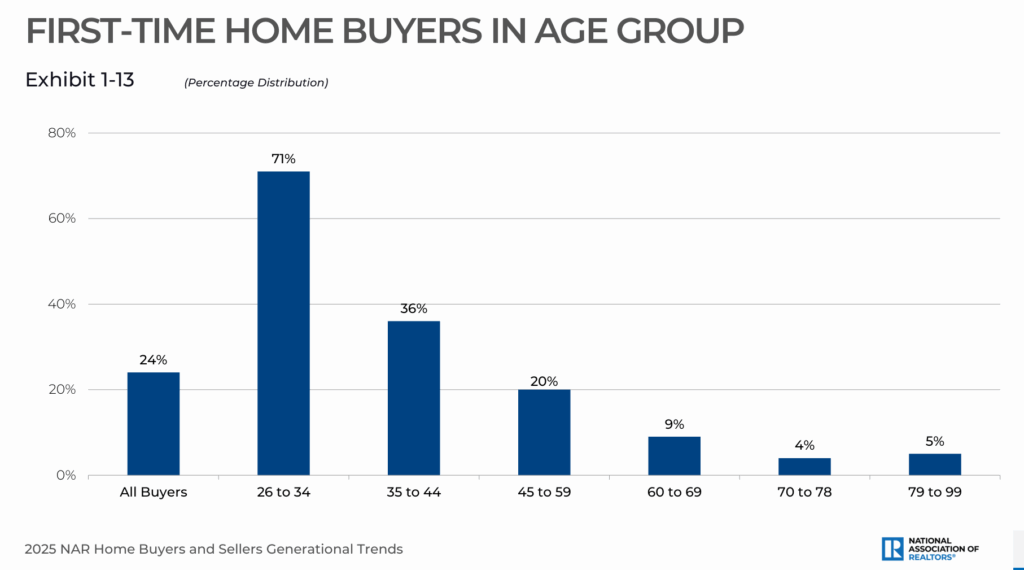

According to the 2025 NAR report, first-time homebuyers made up just 21% of all buyers, the lowest share in NAR’s recorded history. Before the Great Recession, first-timers consistently represented around 40% of buyers. Today’s sharply reduced share highlights both economic realities and shifting life patterns.

Additional highlights from the report include:

📌 Median age for first-time buyers: 40

This is the highest median age ever recorded. Buyers are entering the market later in life—often after establishing careers, paying down debt, or waiting for the right financial moment.

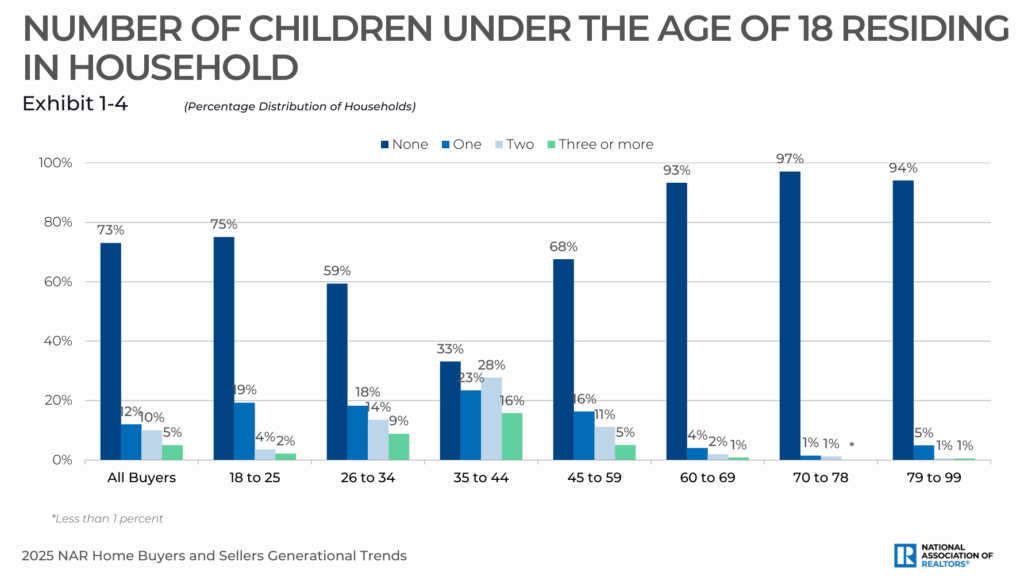

📌 32% of first-time buyers had children under 18

Family-driven moves remain a major factor, but another growing segment is older first-time buyers: individuals or couples who delayed homeownership due to rising prices, student loans, lifestyle preferences, or relocation.

📌 Down payments continue to rise

First-time buyers provided one of the highest median down payments in decades. While repeat buyers averaged around 23%, first-timers typically brought 10% or more, reflecting the need for deeper financial preparation.

Why This Matters in the Omaha Metro

Omaha continues to be a competitive market where knowledge, preparation, and strategy make a measurable difference. For first-time buyers in our area, these national trends show up in a few ways:

1. Later entry = stronger competition

Many first-time buyers are now coming in with more financial stability, making the offer pool more competitive—even at entry-level price points.

2. Local affordability still matters

Even though Omaha is more affordable than many U.S. metros, low inventory, rising prices, and strong demand still create challenges for buyers entering the market.

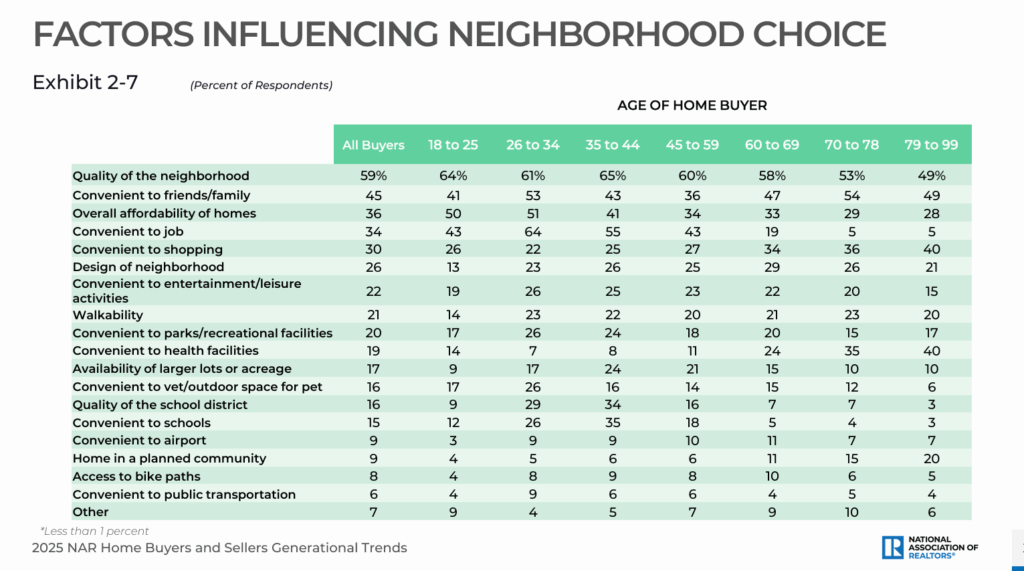

3. Schools and community features are more important than ever

With nearly one-third of first-time buyers having children under 18, neighborhoods with reputable schools, parks, and community amenities remain in high demand across Douglas, Sarpy, and surrounding counties.

4. Preparation = your competitive advantage

First-time buyers who start early—with budgeting, pre-approval, and strategic planning—tend to create the edge they need to succeed, even in a tight market.

How the Omaha Home Pros Team Supports First-Time Buyers

Buying your first home is one of life’s biggest milestones. Our team is structured to give you clarity, confidence, and a step-by-step plan.

💡 Early Financial Readiness Support

We help you map out a realistic plan for down payments, closing costs, monthly affordability, and pre-approval. Knowing exactly what you qualify for—before you begin touring—puts you ahead of many buyers.

💡 Hyper-Local Market Insight

Our team analyzes Omaha-area stats weekly:

- Months of inventory

- Absorption rate

- Average days on market

- Price trends by neighborhood

This means your decisions are driven by real numbers, not guesswork.

💡 Offer Strategy That Works

With fewer first-time buyers in the market, it’s tempting to assume competition is easing—but the buyers who are active tend to be serious and well-prepared. We help you craft strong, compelling offers that stand out.

💡 Looking Ahead to Your Future Equity

As a team that also stages and sells homes, we help buyers think long-term—what updates will pay off, what to avoid, and how to set yourself up for the strongest resale position.

Looking Toward 2026: What Buyers Should Expect

Here’s what we’re watching closely as we move into the new year:

✔ Mortgage rate fluctuations

If rates decline, demand could surge quickly—especially among younger buyers who have been waiting. That means more competition in the entry-level market.

✔ Inventory shifts

Sellers who have held tight through the rate-lock period may begin moving, creating new opportunities for buyers.

✔ Changing demographic patterns

With first-time buyers getting older, the market may see more move-ready, professionally established buyers entering at price points slightly above “starter home” levels.

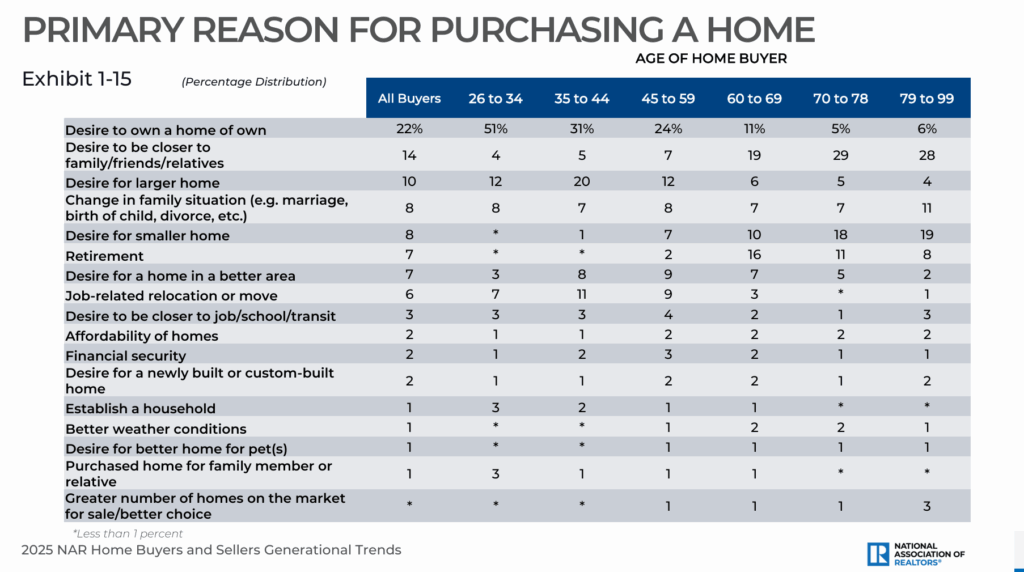

✔ Continued emphasis on lifestyle

Many buyers—first-timers included—will continue prioritizing proximity to friends, family, schools, and workplace flexibility.

Thinking About Buying Your First Home? Start With the Right Plan.

With first-time buyers representing such a small share of this year’s market, preparation is more important than ever. If you’re considering your first purchase in the Omaha metro, our team is here to guide you through every step—clarifying your budget, analyzing neighborhoods, previewing homes, and helping you craft a winning offer.

The best time to start preparing is before you’re ready to buy.

Let’s build your plan together.

Reach out to the Omaha Home Pros Team anytime—we’d love to help you take your next step with confidence.